- PitchDeckGuy

- Posts

- Breaking Down Blackstone's "Investing in Megatrends" Pitch Deck

Breaking Down Blackstone's "Investing in Megatrends" Pitch Deck

Company Overview - Setting the Stage

Blackstone opens with raw firepower: $1.1 trillion AUM across real estate, credit, private equity, and hedge funds. This isn't just bragging - it's showing they've built the infrastructure to deploy massive capital when they spot the right opportunities.

Thematic Investing - The Information Advantage

Here's their secret weapon: using 12,500 real estate assets, 250 companies, and 4,800 credit issuers as a real-time economic radar system. While other investors react to trends after they hit CNBC, Blackstone spots patterns through portfolio data and deploys billions before the market catches on.

Logistics Case Study - Proof of Concept

This approach already delivered their biggest win. They went from under 1% to 40% logistics exposure as e-commerce exploded 10x, buying warehouses while everyone else focused on malls.

Real Estate Portfolio Evolution - The Great Rotation

The logistics success was part of a broader transformation that shows their predictive power. They rotated from 61% office exposure to under 1.5% today while growing logistics, rental housing, and digital infrastructure to 75% of holdings.

Today's Megatrends - The Next Chapter

Now they're applying the same methodology to identify the next wave of opportunities. They've tagged four areas as "infrastructure of the future" - foundational systems requiring decades of capital with stable cash flows.

Four Pillars - The Investment Thesis

Each megatrend targets a different secular shift reshaping the economy. Life Sciences (aging demographics), AI (data explosion), Power (energy overhaul), Digital Economy (physical to digital shift).

AI Infrastructure - Following the Data Trail

The numbers are staggering: global data creation up 101x from 2010-2025, US data center leasing up 16x since 2017. They're not picking which AI company wins - they're buying the infrastructure every AI application needs.

Data Center Dominance - Early Execution

Their $10 billion QTS acquisition already grew leased capacity 9x under their ownership, with 2024 performance 15x higher than projections. They've become the world's largest data center provider with 100% pre-leased developments and 15+ year lease terms.

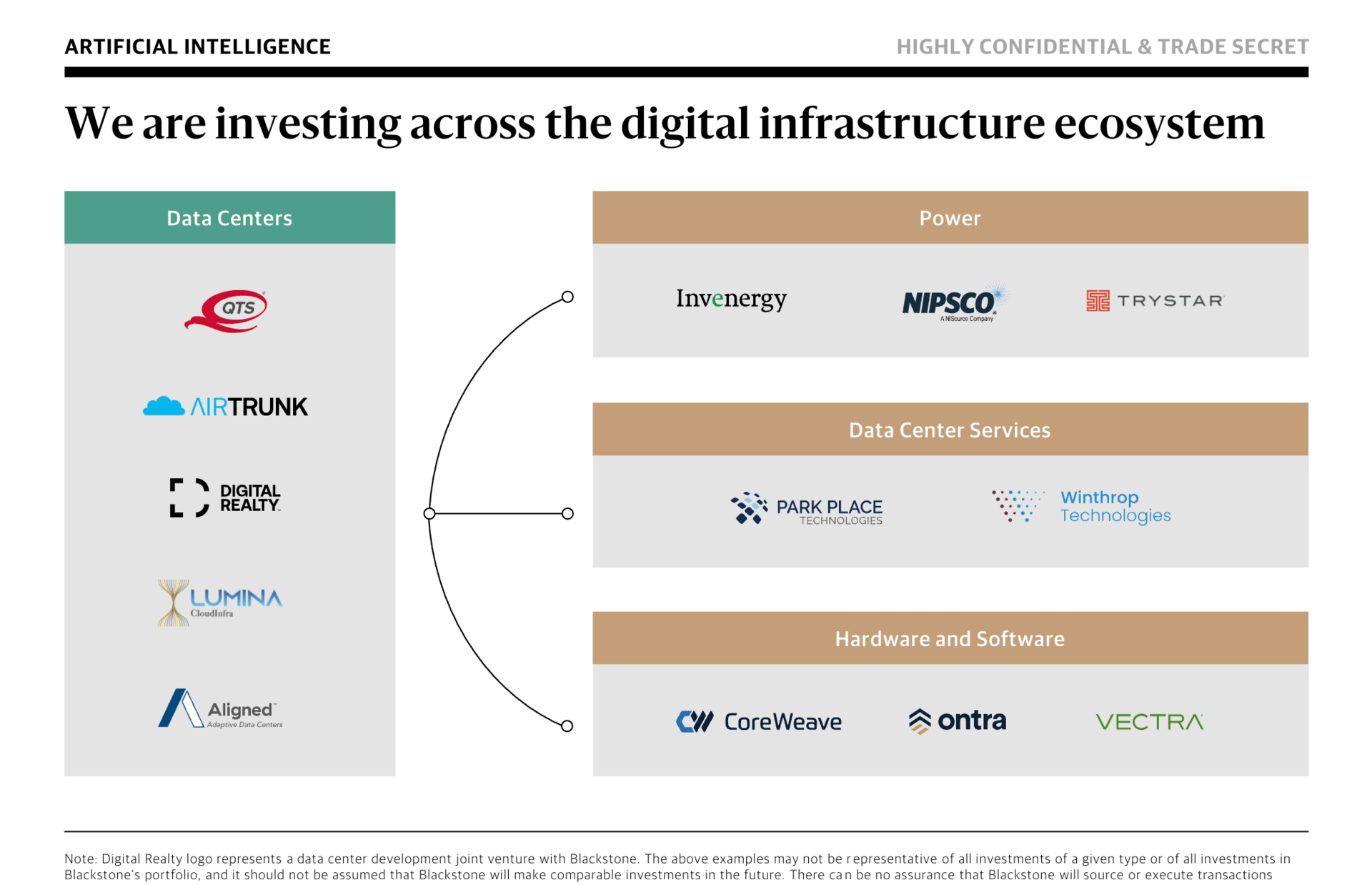

AI Ecosystem Strategy - Total Market Coverage

But they go beyond just server farms - they're investing across power systems, cooling tech, semiconductors, and data center services. If there's a constraint in AI infrastructure, they want to own the solution.

Power Transformation - The Next Infrastructure Play

US electricity demand will surge 40% over the next decade while the aging grid struggles to adapt. The $4 trillion infrastructure gap represents exactly the kind of massive, multi-decade opportunity their scale is built to capture.

Power Value Chain - Comprehensive Positioning

Rather than betting on specific technologies, they're positioning across the entire energy transformation. They're not picking solar versus wind - they're betting the entire energy system needs rebuilding, and every component will generate returns.

Digital Commerce - The Convenience Revolution

E-commerce still outpaces traditional retail (8% vs 2%) while Amazon same-day deliveries surged 65% year-over-year. They're investing across the entire ecosystem enabling this convenience economy, from warehouses to online marketplaces.

Life Sciences - Capitalizing on Medical Progress

Despite remarkable progress (life expectancy up 6 years, cancer deaths down 23%), there's an annual $172 billion funding gap for drug development. They fill this gap with structured financing, earning royalties when drugs succeed.

Additional Themes - Expanding the Playbook

Beyond core infrastructure bets, they apply the same analytical rigor to consumer behavior and geographic trends. Their thematic approach isn't limited to tech and energy - they scan for any secular shift where scale creates advantages.

Franchise Scalability - Consumer Brand Power

Jersey Mike's growth from 324 to 3,002 stores shows how strong brands achieve rapid, capital-efficient expansion. They provide resources to accelerate growth while earning steady royalty income that scales with brand success.

Housing Imbalance - Demographic Tailwinds

America faces a 4-5 million unit shortage while homeownership costs exceed renting by 50% and new construction collapsed 65%. They're investing across all rental categories, benefiting from supply-demand imbalances that'll take years to resolve.

Experience Economy - Capturing Lifestyle Shifts

Since 1959, discretionary spending shifted from goods (-35%) to experiences (+64%), accelerating post-COVID. Their investments in visa processing, theme parks, and resorts position them for this permanent behavioral change.

India Growth - The Geographic Megatrend

India represents their largest geographic bet - world's 5th largest, fastest-growing major economy where they've deployed $55+ billion over 20 years. Their investments span EV supply chains, digital finance, REITs, and logistics, capitalizing on demographics that mirror America's industrial revolution.

Conclusion - The Execution Machine

Blackstone ends simply because the narrative speaks for itself. They've systematically identified major forces reshaping the global economy and positioned themselves to benefit across multiple asset classes - these aren't short-term bets but decade-long trends.

See you next week, PitchDeckGuy

Real quick...

Does your investment thesis tell a story as compelling as Blackstone's? Collateral Partners specializes in creating institutional-quality presentations that resonate with sophisticated investors. From market analysis to competitive positioning, we help managers build world-class marketing materials that capture complex opportunities and drive capital allocation decisions.

What do you think?Give us feedback! |

Reading this and not subscribed?