- PitchDeckGuy

- Posts

- CoreWeave's Strategic Acquisition: Verticalizing the AI Infrastructure Stack

CoreWeave's Strategic Acquisition: Verticalizing the AI Infrastructure Stack

The AI Hyperscaler Makes Its Biggest Move Yet

In a defining moment for the artificial intelligence infrastructure landscape, CoreWeave has announced its acquisition of Core Scientific in a strategic all-stock transaction valued at approximately $9 billion. This move represents more than just expansion—it's a fundamental shift toward vertical integration that could reshape how AI infrastructure is delivered at scale.

What makes this announcement particularly compelling from a strategic communications perspective is how CoreWeave has positioned the narrative. Rather than leading with financial metrics or deal mechanics, they've crafted a story around capability enhancement and market positioning—a masterclass in investor messaging that frames acquisition synergies as strategic inevitabilities rather than hopeful projections.

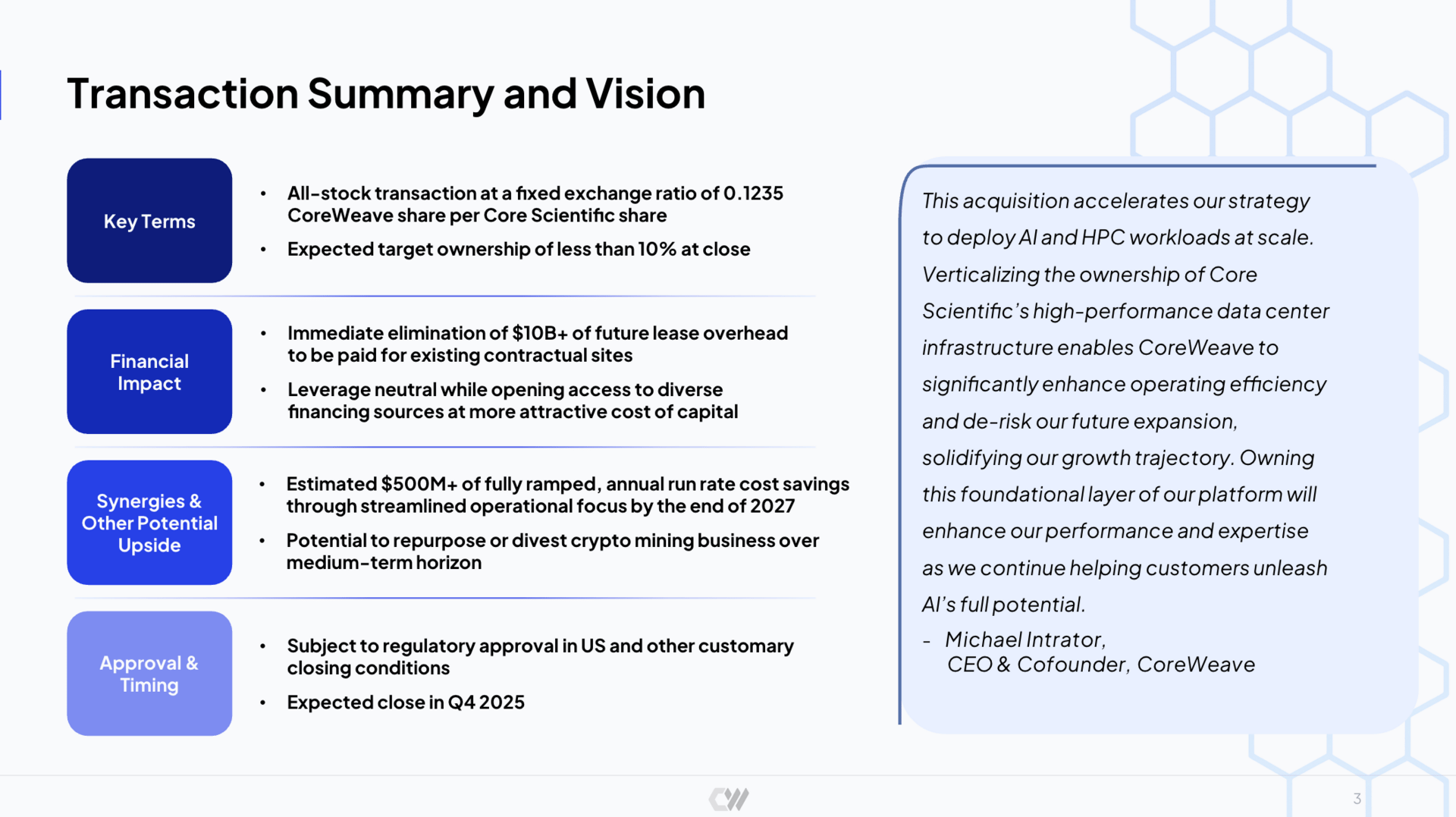

Transaction at a Glance

The deal structure reflects CoreWeave's confidence in its post-IPO trajectory and Core Scientific's strategic value. Under the agreement, Core Scientific shareholders will receive 0.1235 newly issued CoreWeave shares for each share they hold—a fixed exchange ratio that provides certainty in an otherwise volatile market environment.

Expected to close in Q4 2025, the transaction will result in Core Scientific shareholders owning less than 10% of the combined entity. The deal is structured to be leverage-neutral for CoreWeave while immediately eliminating over $10 billion in future lease obligations—a significant balance sheet optimization that speaks to the transaction's strategic merit.

Perhaps most compelling is the projected $500 million in annual cost savings by 2027, achieved through operational efficiencies and the elimination of lease overhead. This isn't just about acquiring capacity—it's about fundamentally improving the economics of AI infrastructure delivery.

The way CoreWeave has structured their investor presentation demonstrates sophisticated understanding of institutional audience priorities. By leading with platform strength and stability before transitioning to opportunity, they've created a compelling investment thesis that resonates with both growth and value-oriented investors.

Why Core Scientific? The Platform Perspective

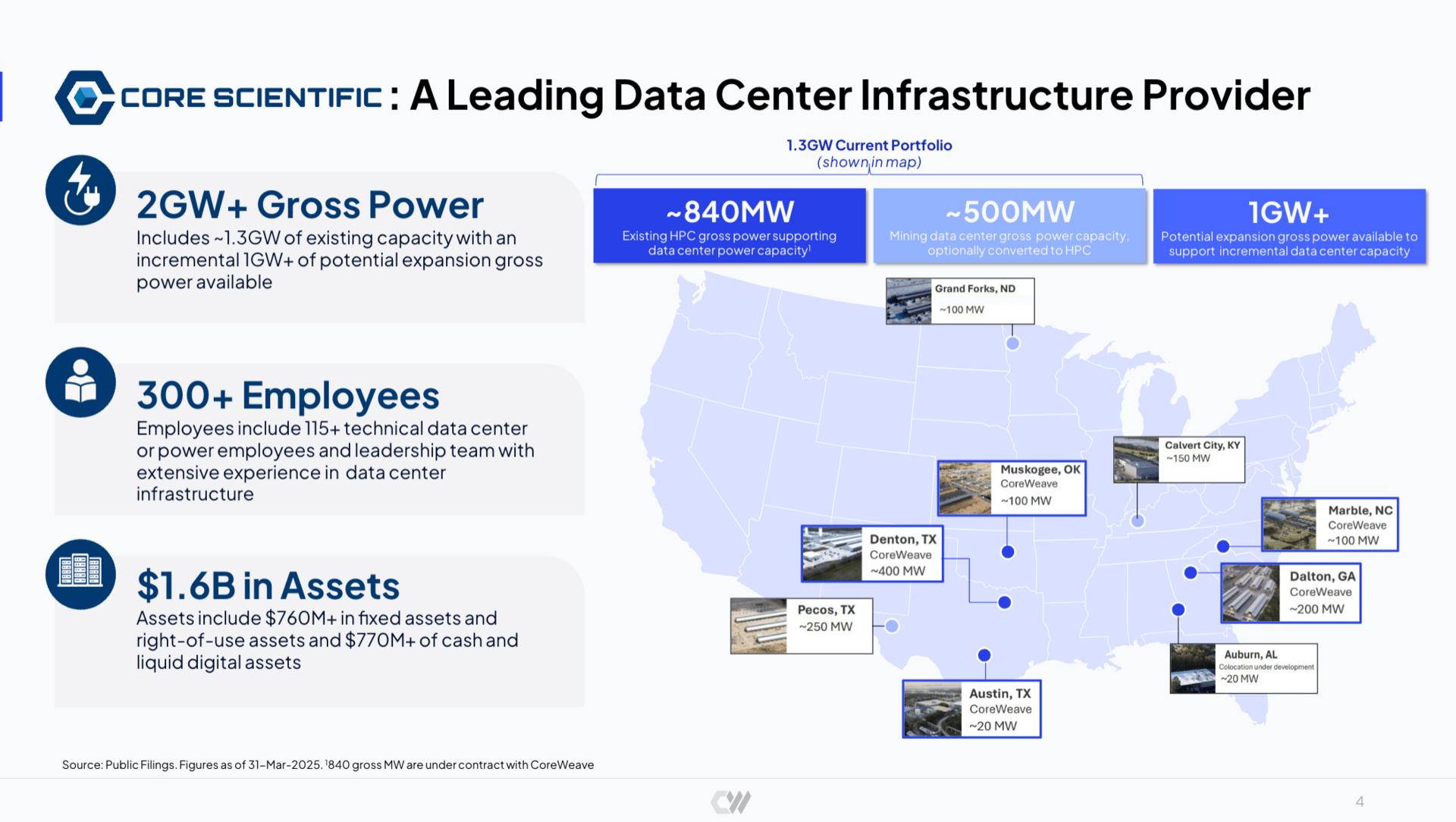

Core Scientific brings more than just power and data centers to the table. The company operates a sophisticated infrastructure platform spanning 2GW+ of gross power capacity across a geographically diverse footprint. Currently, approximately 840MW supports CoreWeave's existing HPC contracts across five sites, while an additional 500MW allocated to cryptocurrency mining presents optionality for conversion or divestiture.

The human capital component cannot be understated. Core Scientific's 300+ employees include 115+ technical data center and power specialists with deep expertise in infrastructure development. This talent acquisition addresses one of the industry's most pressing constraints: the scarcity of experienced professionals who understand the unique demands of high-density AI workloads.

With $1.6 billion in assets, including over $760 million in fixed assets and right-of-use assets, Core Scientific provides immediate scale and established operational capabilities that would take years to develop organically.

Strategic Benefits: Four Pillars of Value Creation

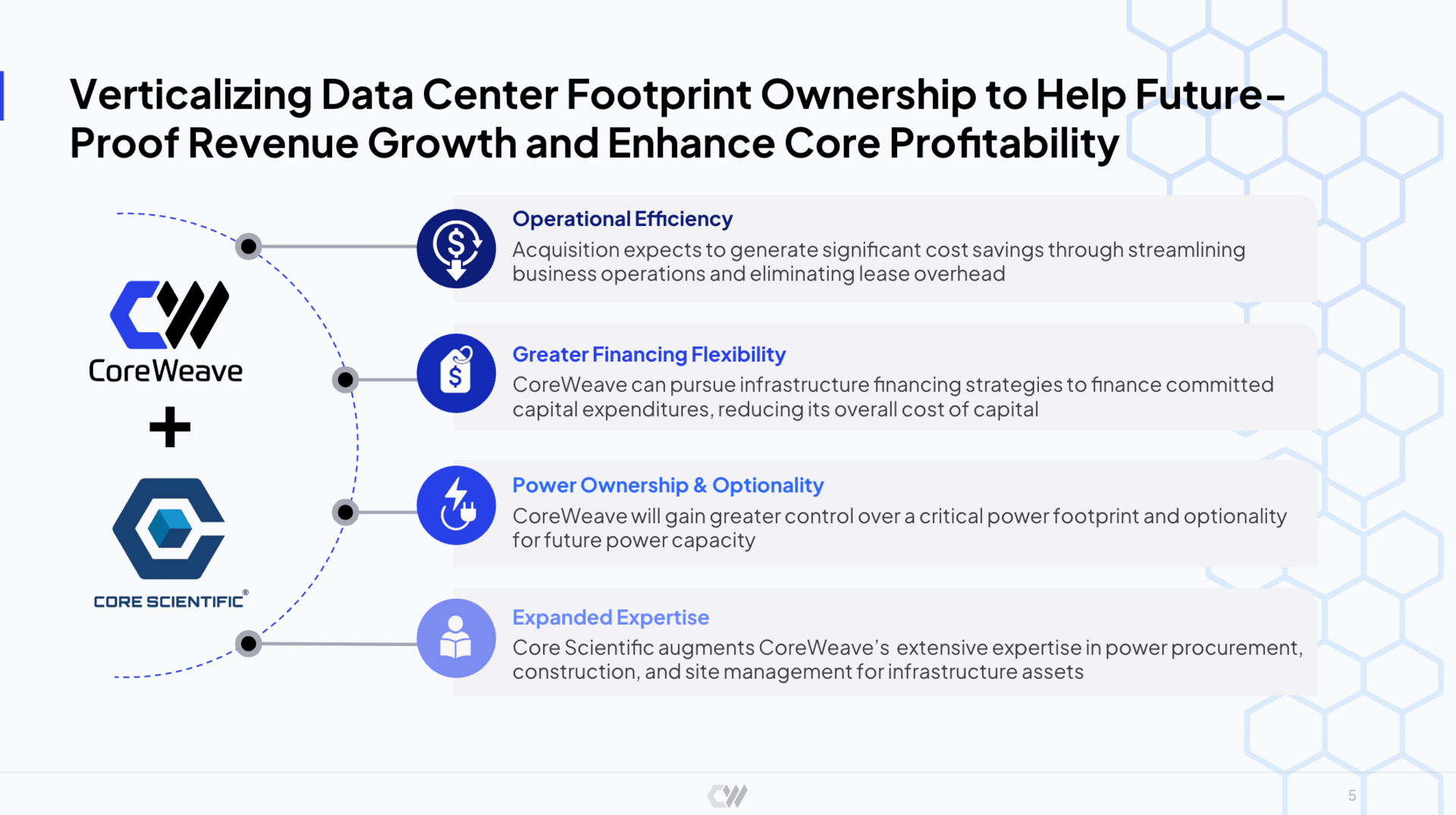

CoreWeave's leadership has articulated a clear value creation framework centered on four strategic benefits that justify the acquisition premium. The visual presentation of these benefits—structured as interconnected pillars rather than a simple list—reinforces the message that this is a comprehensive strategic transformation, not just an opportunistic acquisition:

Operational Efficiency stands as the most immediate benefit. By eliminating third-party lease obligations and streamlining operations, CoreWeave expects significant cost savings that will flow directly to margins. This vertical integration removes friction points and provides greater control over the customer experience.

Greater Financing Flexibility represents a longer-term strategic advantage. Direct ownership of data center assets unlocks infrastructure-specific financing strategies that can significantly reduce the cost of capital. Instead of relying solely on traditional debt or equity financing, CoreWeave can access infrastructure-oriented capital sources typically reserved for asset owners.

Power Ownership and Optionality addresses one of the most critical constraints in AI infrastructure: access to reliable, scalable power. The acquisition provides not just current capacity but also expansion optionality that positions CoreWeave to meet growing demand without the typical development timelines and regulatory hurdles.

Expanded Expertise brings together two complementary skill sets. CoreWeave's cutting-edge AI and software capabilities combined with Core Scientific's deep infrastructure engineering expertise creates a platform uniquely positioned to tackle next-generation architectural challenges.

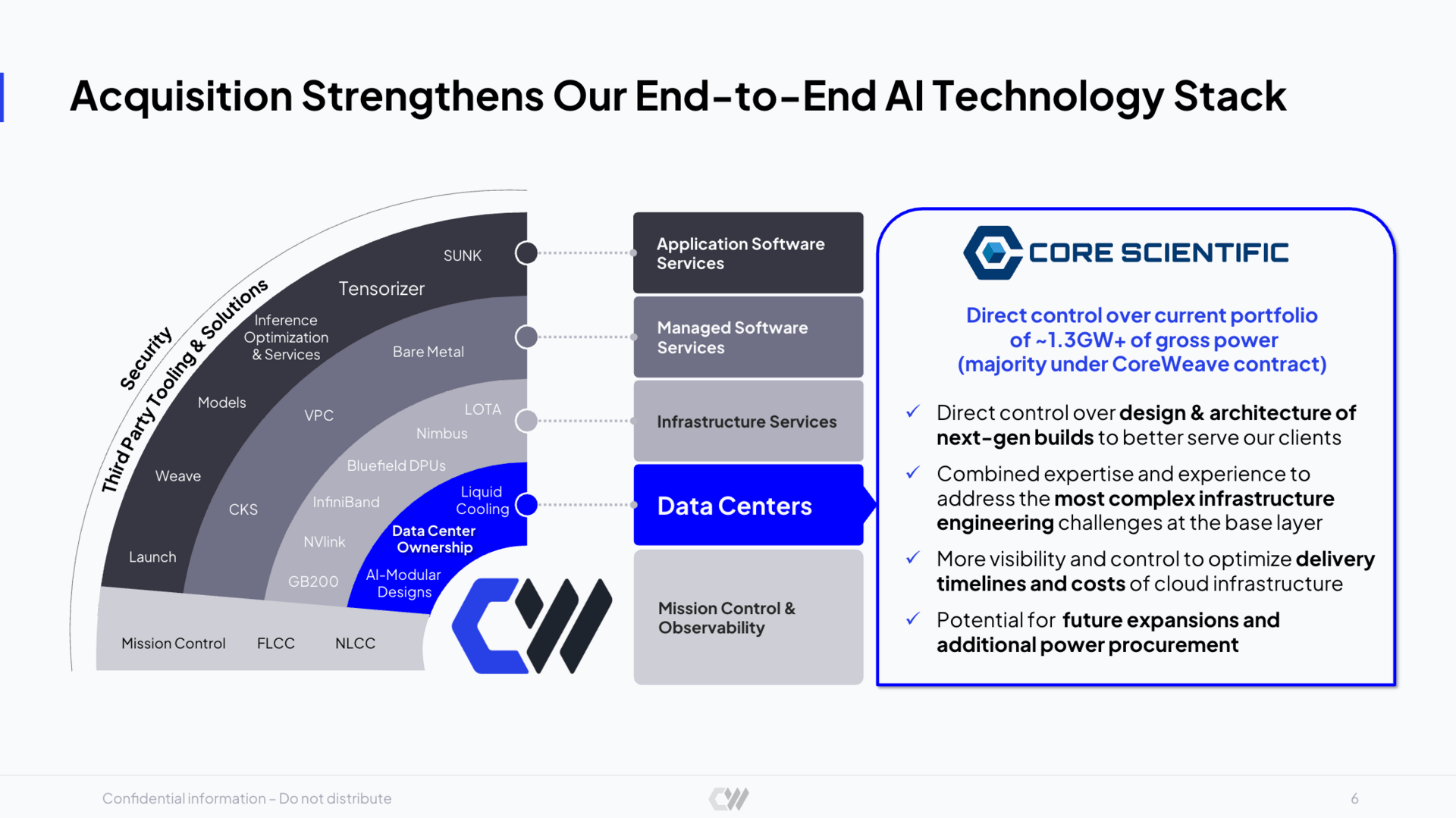

Strengthening the Technology Stack

The acquisition represents a strategic move down the infrastructure stack, giving CoreWeave control over the foundational layer that powers its AI cloud platform. This vertical integration enables faster, more tailored deployments for high-density AI workloads while improving cost efficiency and delivery timeline visibility.

By controlling the design, architecture, and execution of data center builds, CoreWeave can optimize performance, efficiency, and economics at the base layer. This capability becomes increasingly important as AI workloads grow more demanding and customers require more sophisticated infrastructure solutions.

The combined platform positions CoreWeave to innovate across the entire stack, from power and cooling systems to software orchestration layers—a level of integration that few competitors can match.

Financial Impact and Margin Expansion

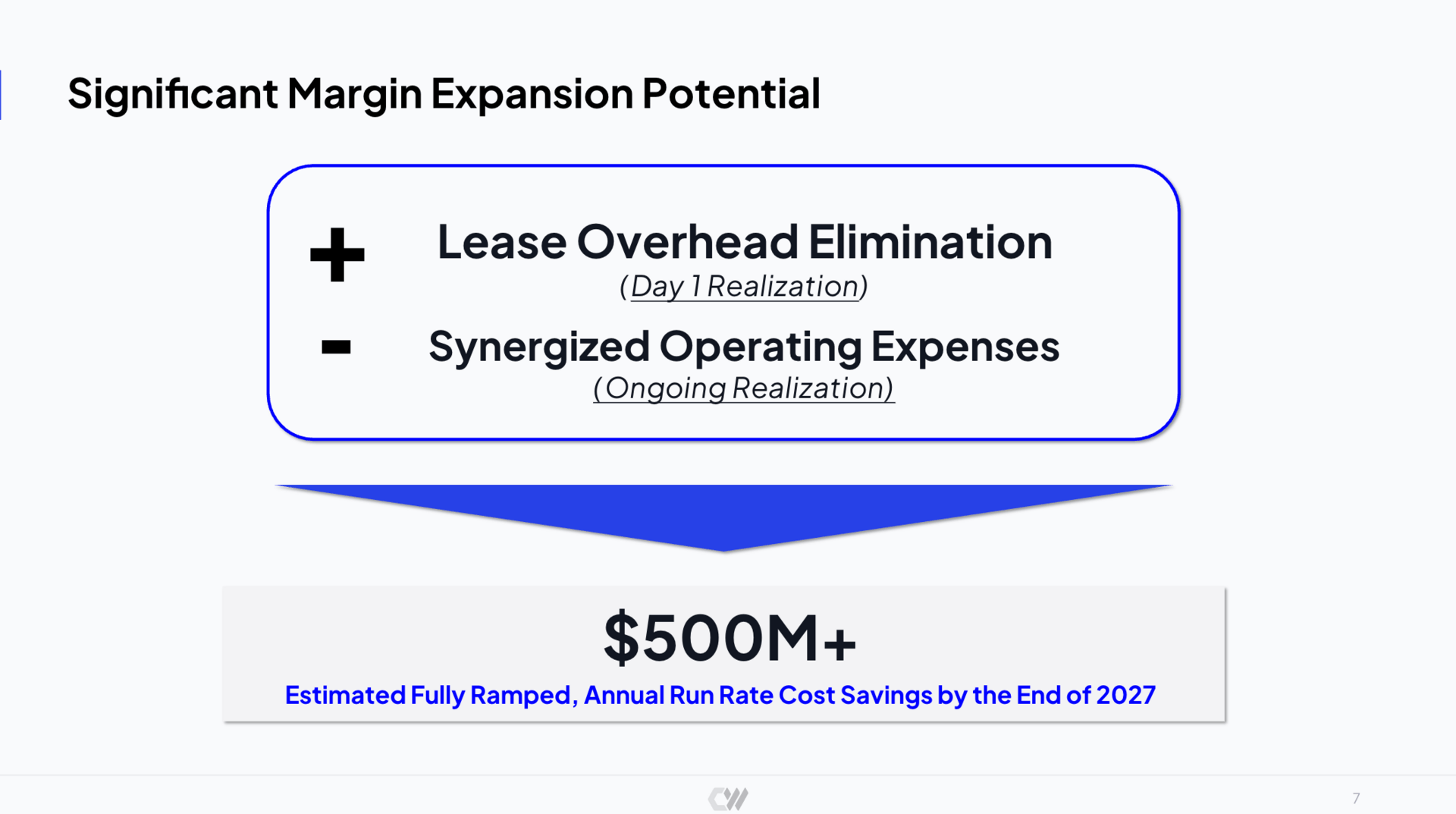

The financial rationale for the acquisition extends beyond simple cost savings. CoreWeave has identified significant margin expansion potential through two primary mechanisms: immediate lease overhead elimination and ongoing operational synergies.

Their presentation methodology here is particularly noteworthy—by quantifying specific savings targets ($500M+) and providing a clear timeline (by end of 2027), they've transformed what could be vague synergy promises into concrete, measurable commitments that institutional investors can model and track.

The elimination of lease payments provides immediate relief, while operational efficiencies develop over time as the combined organization streamlines processes and eliminates redundancies. By 2027, CoreWeave expects fully ramped annual cost savings of over $500 million—a substantial improvement that will enhance competitiveness and profitability.

This margin expansion comes at a critical time as the AI infrastructure market becomes increasingly competitive. The ability to deliver superior economics while maintaining service quality provides a sustainable competitive advantage.

Capacity and Financing Optimization

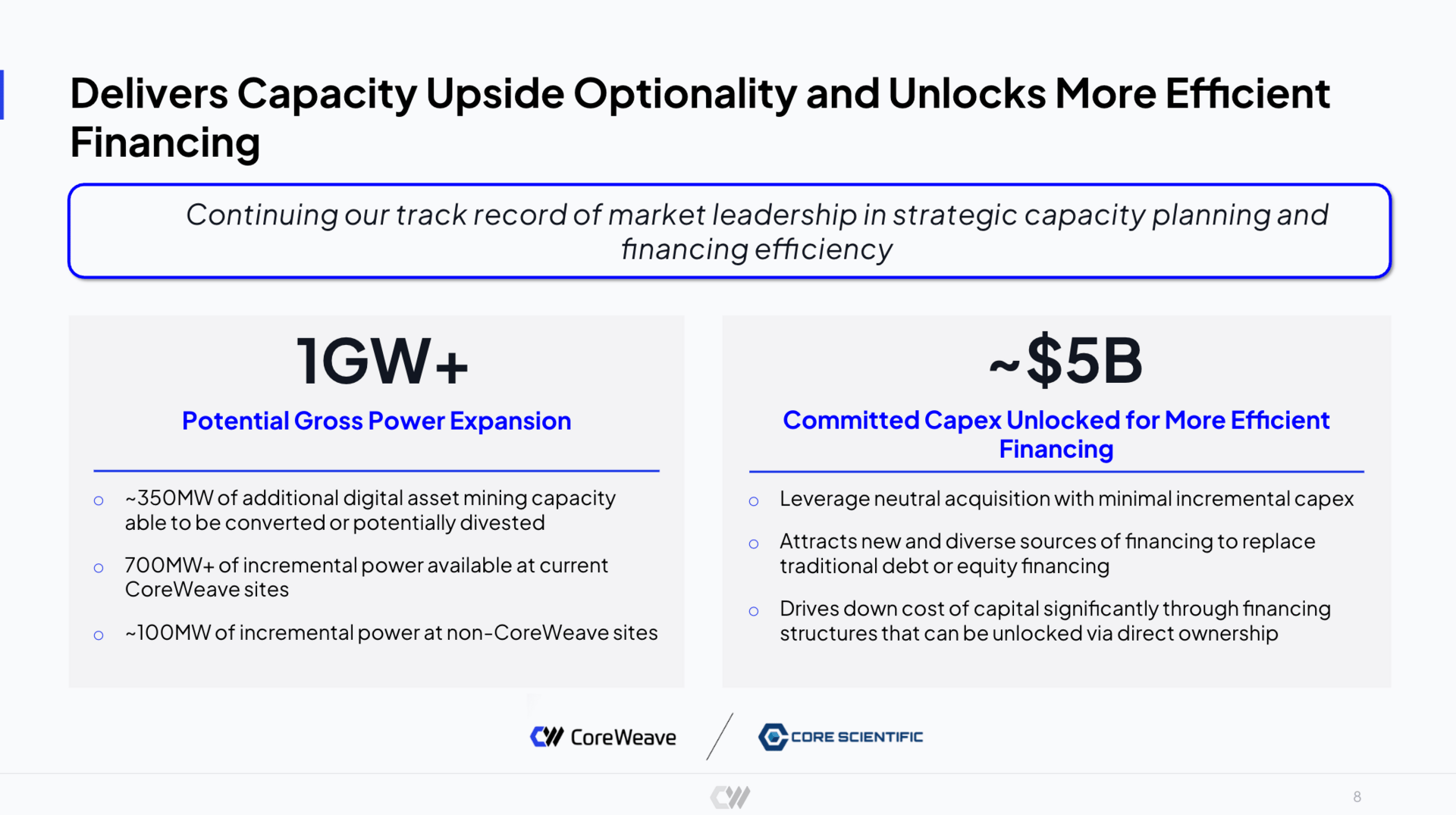

Beyond operational improvements, the acquisition delivers two critical long-term advantages: expanded capacity optionality and financing optimization.

The 1GW+ of potential expansion capacity includes 700MW+ at existing CoreWeave sites, 100MW at non-CoreWeave locations, and 350MW from digital asset mining operations that can be converted or divested. This flexibility allows CoreWeave to respond dynamically to market demands without the typical lead times associated with greenfield development.

Perhaps more importantly, the acquisition unlocks approximately $5 billion in committed capital expenditures for more efficient financing. As an asset owner, CoreWeave can access infrastructure-oriented financing vehicles that typically offer more attractive terms than traditional corporate financing. This capability could drive down the cost of capital significantly, improving returns and enabling more competitive pricing.

Market Context and Strategic Timing

The timing of this acquisition reflects broader market dynamics that make vertical integration increasingly attractive. As AI workloads become more demanding and customers require greater certainty of capacity and performance, controlling the entire infrastructure stack provides competitive advantages that pure software or service providers cannot match.

The deal also positions CoreWeave to compete more effectively with hyperscale cloud providers who already own their infrastructure. By eliminating the dependency on third-party data center operators, CoreWeave gains flexibility, control, and economic advantages that directly translate to customer value.

Looking Forward: Integration and Execution

Success will ultimately depend on execution. CoreWeave must integrate Core Scientific's operations while maintaining service levels and capturing projected synergies. The company's track record with previous acquisitions, including Weights & Biases, provides confidence in their integration capabilities.

From a strategic communications standpoint, CoreWeave's approach to this acquisition announcement exemplifies best practices in institutional investor relations. By balancing aspirational vision with concrete operational details, they've created a narrative that addresses both the strategic rationale and execution roadmap—essential elements for maintaining investor confidence through the integration process.

The transaction represents more than just growth—it's a strategic repositioning that could define CoreWeave's competitive position for years to come. By verticalizing their infrastructure stack, CoreWeave has positioned itself to deliver the scale, performance, and economics that the next generation of AI applications will demand.

As the AI infrastructure market continues to evolve, this acquisition may well be viewed as a defining moment when CoreWeave transformed from a specialized AI cloud provider into a fully integrated AI infrastructure platform. The success of this strategy will likely influence how other players in the ecosystem think about vertical integration and competitive positioning.

For investors and industry observers, the CoreWeave-Core Scientific combination offers a compelling case study in strategic value creation through vertical integration—a reminder that in rapidly evolving technology markets, controlling critical infrastructure can provide sustainable competitive advantages that pure software solutions cannot match.

See you next week, PitchDeckGuy

Real quick...

Does your investment thesis tell a story as compelling as Apollo's? Collateral Partners specializes in creating institutional-quality presentations that resonate with sophisticated investors. From market analysis to competitive positioning, we help managers build world-class marketing materials that capture complex opportunities and drive capital allocation decisions.

What do you think?Give us feedback! |

Reading this and not subscribed?